32+ Goodwill accounting example List

Home » Bitcoin » 32+ Goodwill accounting example ListYour Goodwill accounting example coin are available in this site. Goodwill accounting example are a coin that is most popular and liked by everyone now. You can Find and Download the Goodwill accounting example files here. Get all royalty-free bitcoin.

If you’re looking for goodwill accounting example images information related to the goodwill accounting example interest, you have pay a visit to the right site. Our site always gives you hints for seeking the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

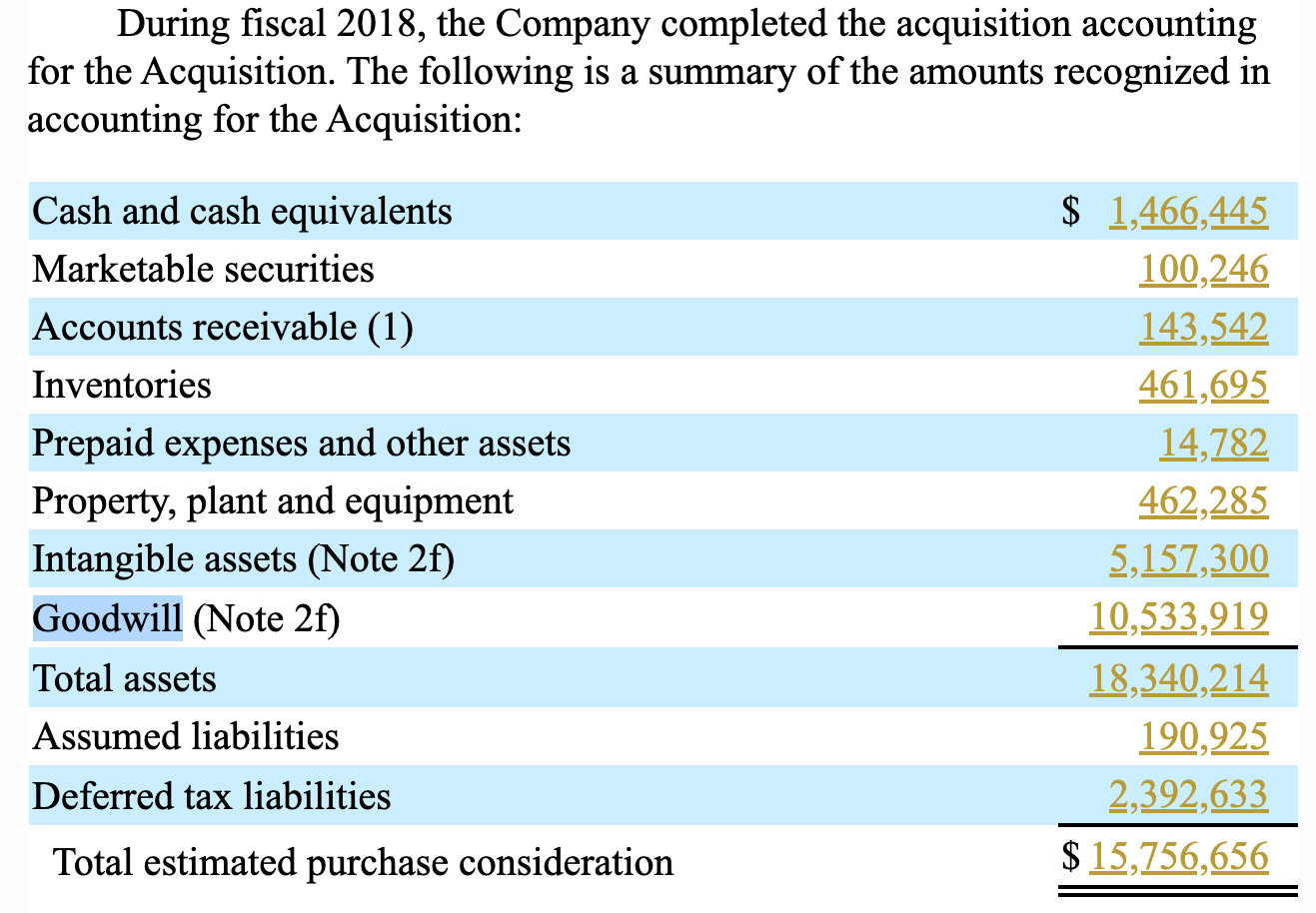

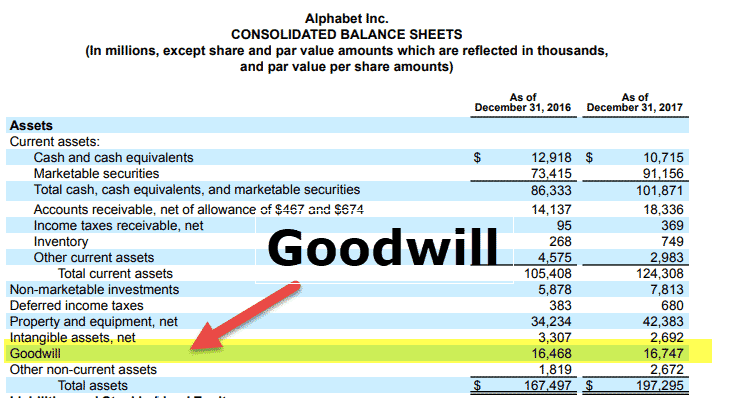

Goodwill Accounting Example. Goodwill occurs when one company acquires another for a price higher than the fair market value of its assets. Answer 1 of 5. For example if they have acquired goodwill on their financial statements they should have a right or a formal proof of understanding between parties that they have the right to show this as acquired goodwill in the financial statements. Negative goodwill also called a bargain-purchase amount when a company buys an asset of another company for less than its fair market value.

Goodwill Example Meaning Investinganswers From investinganswers.com

Goodwill Example Meaning Investinganswers From investinganswers.com

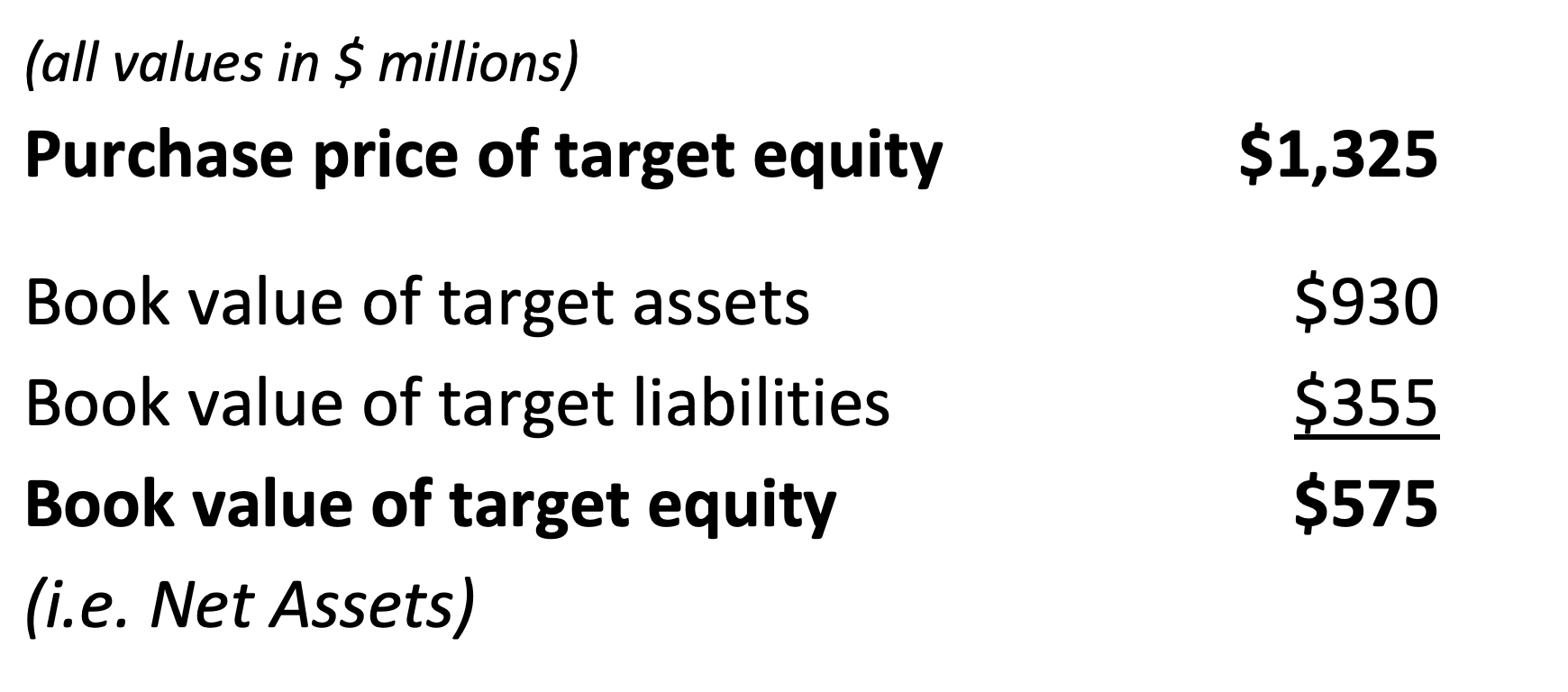

Goodwill occurs when one company acquires another for a price higher than the fair market value of its assets. The goodwill amounts to the excess of the purchase consideration the money paid to purchase the asset or business over the net value of the assets minus liabilities. The difference between the price a company pays for another company and the book value of the purchased company. For example Company ABC may purchase Company XYZ for more than the fair value of its assets and debts. Goodwill Calculation Example1. Accounting Accumulated Amortization Goodwill Goodwill Accounting Example Goodwill Accounting Term Goodwill Definition Is Goodwill An Intangible Asset.

Example of Goodwill If the fair value of Company ABCs assets minus liabilities is 12 billion and a company purchases Company ABC for 15.

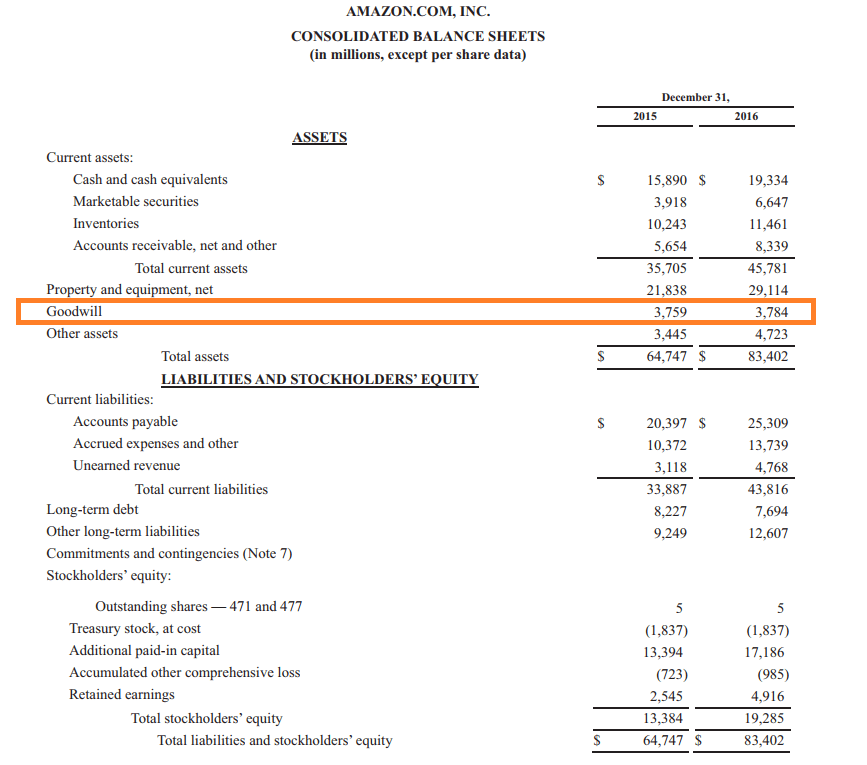

The capitalized value of this excess return is economic goodwill Accounting for Goodwill Journal Entries The journal entry is as follows. The purchase consideration is 100 million in order to obtain a 95 stake in XYZ Ltd. Negative goodwill is the opposite site of goodwill. Most companies pay more than the book value of another company when they are buying it because book value isnt necessarily the most useful way of looking at the value. TangibleIntangible Assets and Negative Goodwill. For example the largest goodwill balance in the sample belongs to ATT which has acquired Time Warner and Direct TV in recent years each at a significant premium over the sum of the fair value of the identifiable net assets 386 billion and 344 billion allocated to goodwill respectively.

Source: breakingintowallstreet.com

Source: breakingintowallstreet.com

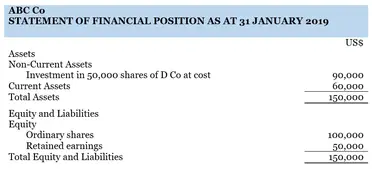

Calculate the group goodwill and goodwill attributable to NCI. Group Goodwill million. For example the largest goodwill balance in the sample belongs to ATT which has acquired Time Warner and Direct TV in recent years each at a significant premium over the sum of the fair value of the identifiable net assets 386 billion and 344 billion allocated to goodwill respectively. This amount is nearly always a positive number. Negative goodwill is the opposite site of goodwill.

Source: calcbench.com

Source: calcbench.com

The amount remaining would be listed on Company ABCs balance sheet as goodwill. Goodwill is defined as the price paid in excess of the firms fair value. EXAMPLE 1 Laldi Co acquired control of Bidle Co on 31 March 20X6 Laldi Cos year end. The purchase consideration is 100 million in order to obtain a 95 stake in XYZ Ltd. Cash Account Debit 600000.

Source: accountinghub-online.com

Source: accountinghub-online.com

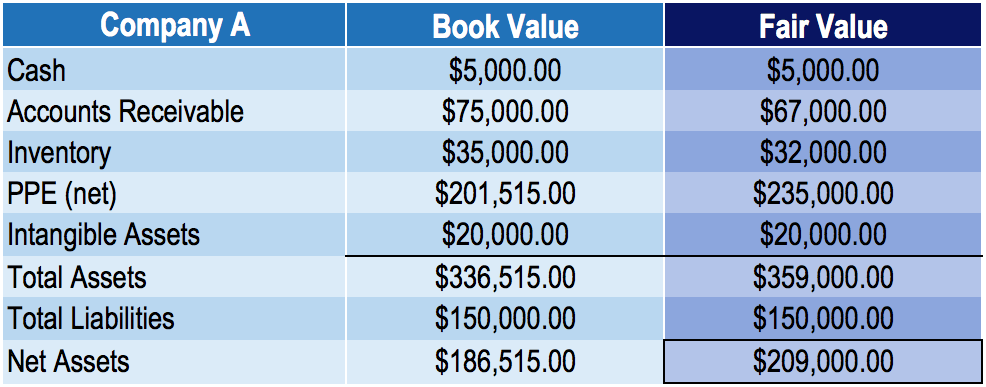

The capitalized value of this excess return is economic goodwill Accounting for Goodwill Journal Entries The journal entry is as follows. It is important to distinguish between tangible and intangible assets. Goodwill occurs when one company acquires another for a price higher than the fair market value of its assets. The net assets of the XYZ are valued fairly at 4000000 which comes from the total assets of 15000000 and total liabilities of 11000000 measured at fair value as listed in the table below. The capitalized value of this excess return is economic goodwill Accounting for Goodwill Journal Entries The journal entry is as follows.

Source: investinganswers.com

Source: investinganswers.com

Calculate the group goodwill and goodwill attributable to NCI. A key thing to note here is that goodwill is unaffected as goodwill is only calculated at the date control is gained. Goodwill account will be credit because it will decrease the asset of goodwill. The capitalized value of this excess return is economic goodwill Accounting for Goodwill Journal Entries The journal entry is as follows. At that time the fair value of net assets of S Company was 62 million and fair value of NCI was 19 million.

Source: accountinghub-online.com

Source: accountinghub-online.com

Goodwill is defined as the price paid in excess of the firms fair value. The fair value differs from book value in the example above because. For example Company ABC may purchase Company XYZ for more than the fair value of its assets and debts. The purchase consideration is 100 million in order to obtain a 95 stake in XYZ Ltd. The capitalized value of this excess return is economic goodwill Accounting for Goodwill Journal Entries The journal entry is as follows.

Source: annualreporting.info

Source: annualreporting.info

Pass the journal entry. Goodwill Calculation Example1. The purchase consideration is 100 million in order to obtain a 95 stake in XYZ Ltd. For example if they have acquired goodwill on their financial statements they should have a right or a formal proof of understanding between parties that they have the right to show this as acquired goodwill in the financial statements. Goodwill is an intangible asset that arises when one company purchases another company.

Source: marqueegroup.ca

Source: marqueegroup.ca

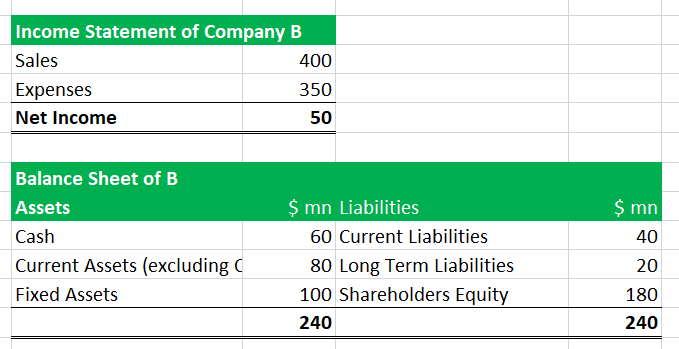

Let us take the example of company ABC Ltd which has agreed to acquire company XYZ Ltd. It is important to distinguish between tangible and intangible assets. Then it is impaired for the entire 5 million and other assets acquired are proportionately by 1 million. Goodwill is created when one company acquires another for a price higher than the fair market value of its assets. At that time the fair value of net assets of S Company was 62 million and fair value of NCI was 19 million.

Source: slidetodoc.com

Source: slidetodoc.com

EXAMPLE 1 Laldi Co acquired control of Bidle Co on 31 March 20X6 Laldi Cos year end. For example if Company A buys Company B for more than the fair value of Company Bs assets and debts the amount left over is listed on Company As balance sheet as goodwill. Company A reports the following amounts. Goodwill Calculation Example1. Pass the journal entry.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Accounting Accumulated Amortization Goodwill Goodwill Accounting Example Goodwill Accounting Term Goodwill Definition Is Goodwill An Intangible Asset. Let us assume a company ABC ltd. So Goodwill is the Value of Positive Attributes that an acquirer company is willing to pay in order to get these Favourable Attributes to Stabilize its Business and gain success in the business. Purchase of a Company. Specifically it is the portion of the purchase price that is higher than the sum of the net fair value of all of the assets purchased in the acquisition and the liabilities assumed in the process.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

A key thing to note here is that goodwill is unaffected as goodwill is only calculated at the date control is gained. Goodwill occurs when one company acquires another for a price higher than the fair market value of its assets. The amount remaining would be listed on Company ABCs balance sheet as goodwill. Example of goodwill in accounting. The net assets of the XYZ are valued fairly at 4000000 which comes from the total assets of 15000000 and total liabilities of 11000000 measured at fair value as listed in the table below.

Source: wikihow.com

Source: wikihow.com

Example of Goodwill If the fair value of Company ABCs assets minus liabilities is 12 billion and a company purchases Company ABC for 15. Suppose P Company acquired 85 shares of S Company by paying 75 million. For example the largest goodwill balance in the sample belongs to ATT which has acquired Time Warner and Direct TV in recent years each at a significant premium over the sum of the fair value of the identifiable net assets 386 billion and 344 billion allocated to goodwill respectively. If company is gaining profit from sale of goodwill it will also credit For example. Specifically it is the portion of the purchase price that is higher than the sum of the net fair value of all of the assets purchased in the acquisition and the liabilities assumed in the process.

Source: bankingprep.com

Source: bankingprep.com

EXAMPLE 1 Laldi Co acquired control of Bidle Co on 31 March 20X6 Laldi Cos year end. Goodwill is defined as the price paid in excess of the firms fair value. ABC company sold same XYZ after buying to MNO company at 600000 but book value is same as 500000. Goodwill Calculation Example1. Suppose P Company acquired 85 shares of S Company by paying 75 million.

Source: researchgate.net

Source: researchgate.net

For example if your excess purchase price is 400000 and your fair value adjustment is 100000 your goodwill amount would be 300000. The net assets of the XYZ are valued fairly at 4000000 which comes from the total assets of 15000000 and total liabilities of 11000000 measured at fair value as listed in the table below. For example In the above example ABC Co acquired assets for 12 million where 5 million is Goodwill and when the market value of assets dropped to 6 million then 6 million 12-6 has to be impaired. Goodwill occurs when one company acquires another for a price higher than the fair market value of its assets. Example of goodwill in accounting.

Source: wikihow.com

Source: wikihow.com

To understand it in more depth lets look at an example. The purchase consideration is 100 million in order to obtain a 95 stake in XYZ Ltd. Goodwill is an intangible asset that arises when one company purchases another company. Specifically it is the portion of the purchase price that is higher than the sum of the net fair value of all of the assets purchased in the acquisition and the liabilities assumed in the process. Goodwill account will be credit because it will decrease the asset of goodwill.

Source: financiopedia.com

Source: financiopedia.com

If company is gaining profit from sale of goodwill it will also credit For example. Group Goodwill million. The net assets of the XYZ are valued fairly at 4000000 which comes from the total assets of 15000000 and total liabilities of 11000000 measured at fair value as listed in the table below. Calculate the group goodwill and goodwill attributable to NCI. For example if Company A buys Company B for more than the fair value of Company Bs assets and debts the amount left over is listed on Company As balance sheet as goodwill.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Goodwill Example To put it in a simple term a Company named ABCs assets minus liabilities is 10 crores and another company purchases the company ABC for 15 crores the premium value following the acquisition is 5 crores. Goodwill account will be credit because it will decrease the asset of goodwill. This amount is nearly always a positive number. It is important to distinguish between tangible and intangible assets. Then it is impaired for the entire 5 million and other assets acquired are proportionately by 1 million.

Source: breakingintowallstreet.com

Source: breakingintowallstreet.com

It is important to distinguish between tangible and intangible assets. Pass the journal entry. Accounting Accumulated Amortization Goodwill Goodwill Accounting Example Goodwill Accounting Term Goodwill Definition Is Goodwill An Intangible Asset. Goodwill occurs when one company acquires another for a price higher than the fair market value of its assets. So Goodwill is the Value of Positive Attributes that an acquirer company is willing to pay in order to get these Favourable Attributes to Stabilize its Business and gain success in the business.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Goodwill Example To put it in a simple term a Company named ABCs assets minus liabilities is 10 crores and another company purchases the company ABC for 15 crores the premium value following the acquisition is 5 crores. TangibleIntangible Assets and Negative Goodwill. The difference between the price a company pays for another company and the book value of the purchased company. Specifically it is the portion of the purchase price that is higher than the sum of the net fair value of all of the assets purchased in the acquisition and the liabilities assumed in the process. For example if your excess purchase price is 400000 and your fair value adjustment is 100000 your goodwill amount would be 300000.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title goodwill accounting example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.