21++ Goodwill meaning in accounting Popular

Home » News » 21++ Goodwill meaning in accounting PopularYour Goodwill meaning in accounting exchange are obtainable. Goodwill meaning in accounting are a coin that is most popular and liked by everyone this time. You can Find and Download the Goodwill meaning in accounting files here. Get all free coin.

If you’re searching for goodwill meaning in accounting pictures information related to the goodwill meaning in accounting keyword, you have come to the ideal site. Our website frequently provides you with hints for refferencing the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

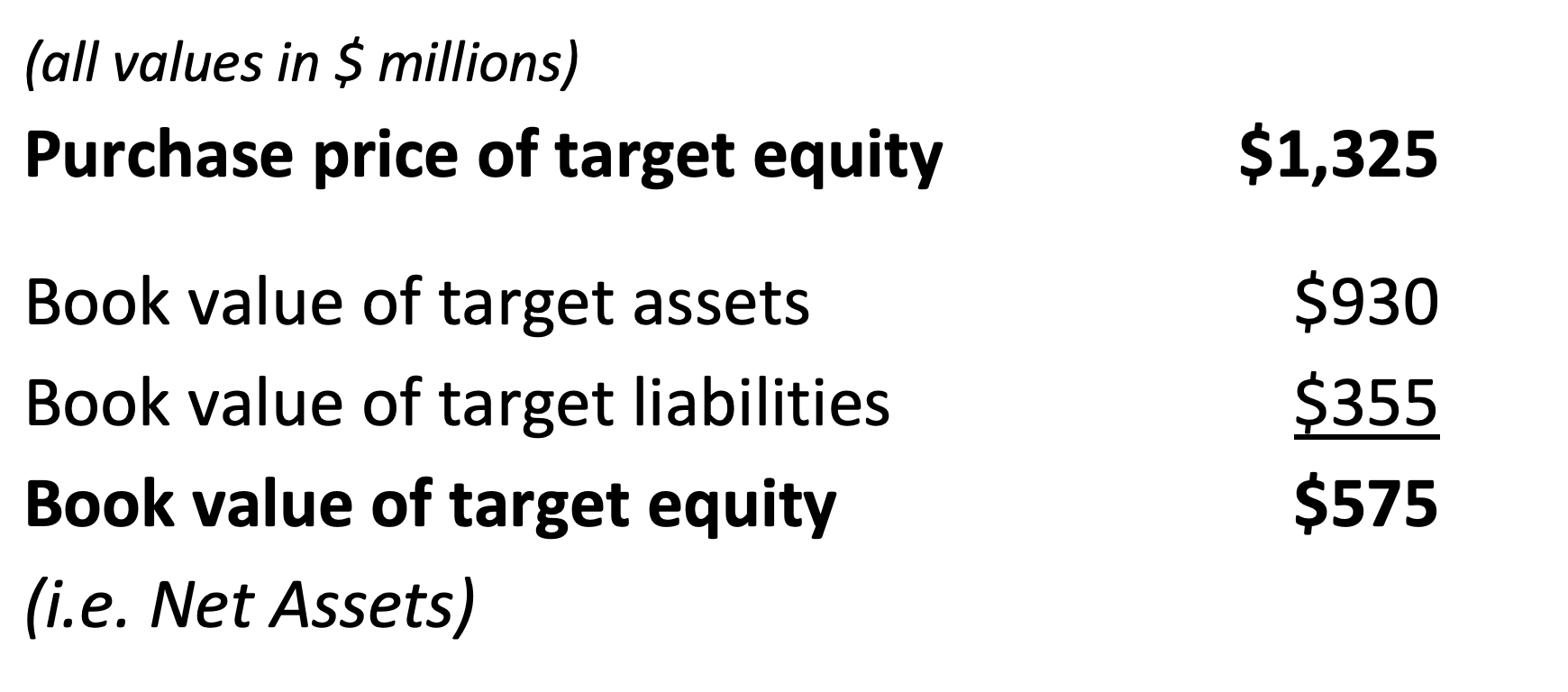

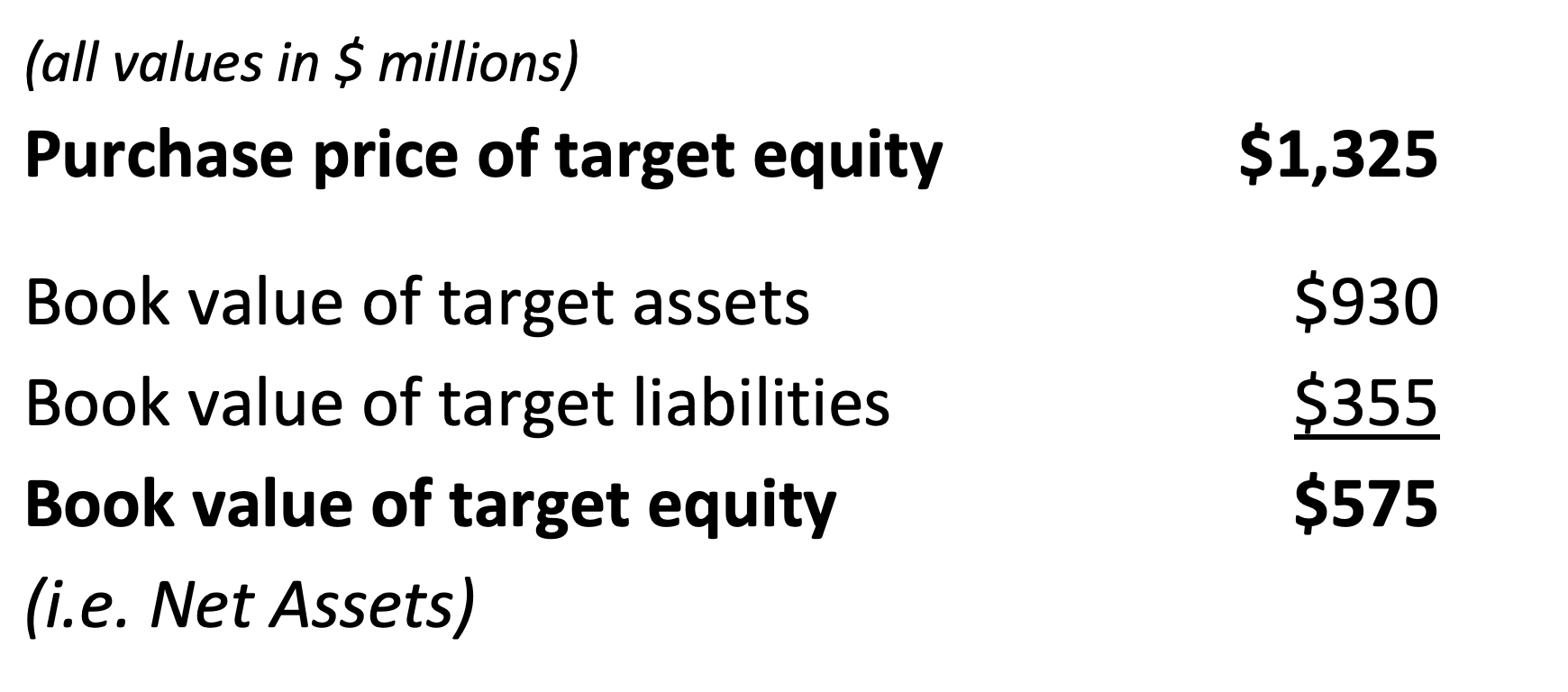

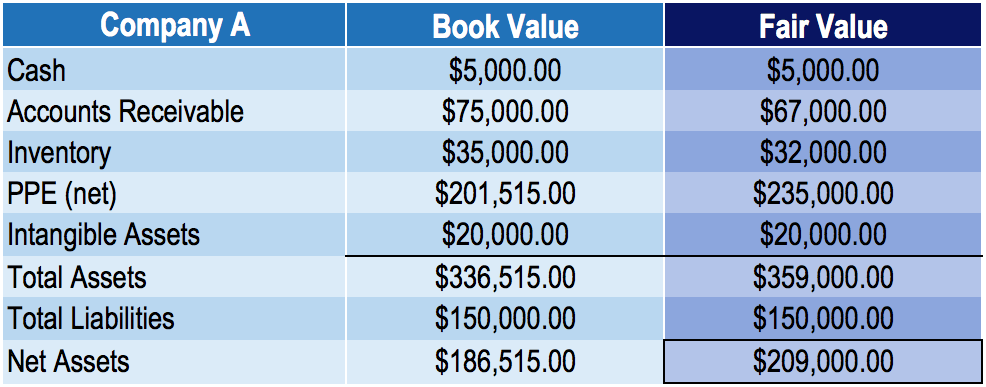

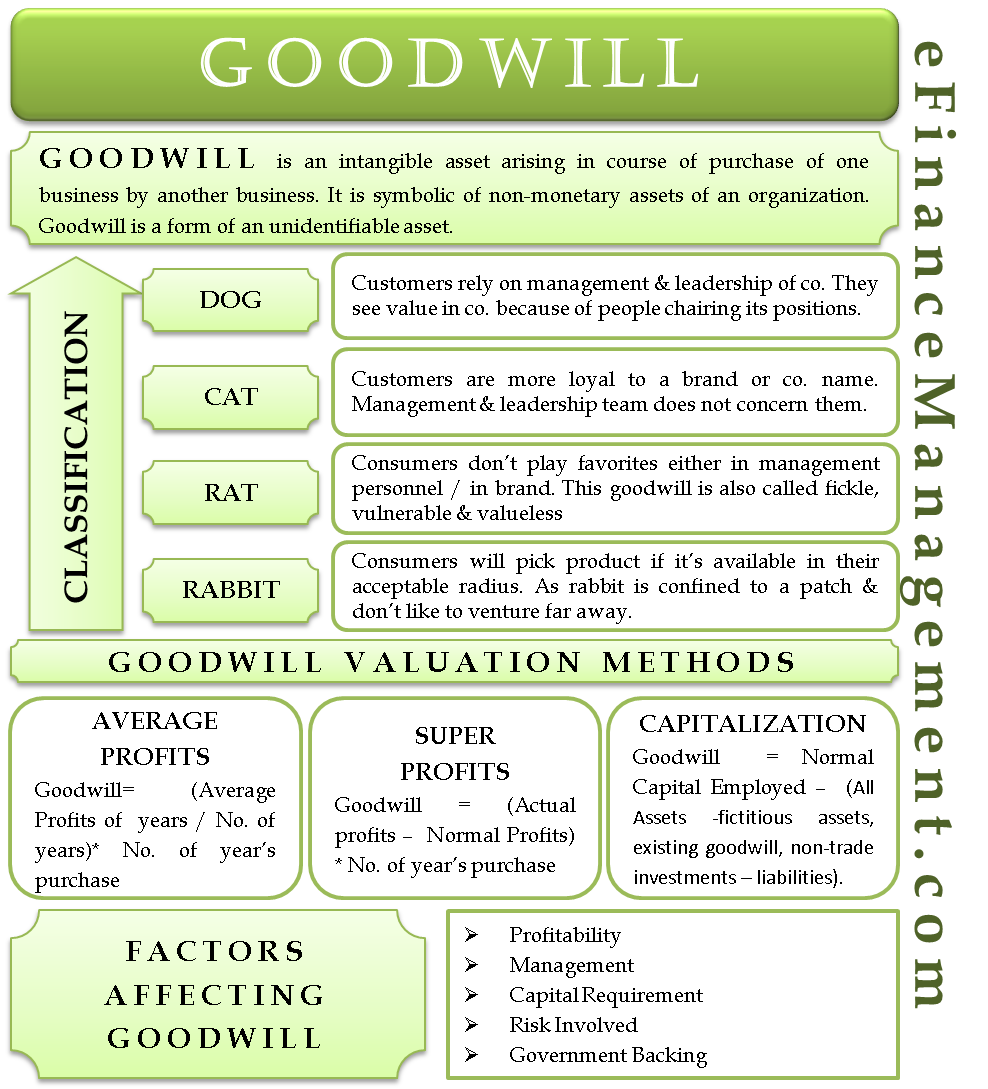

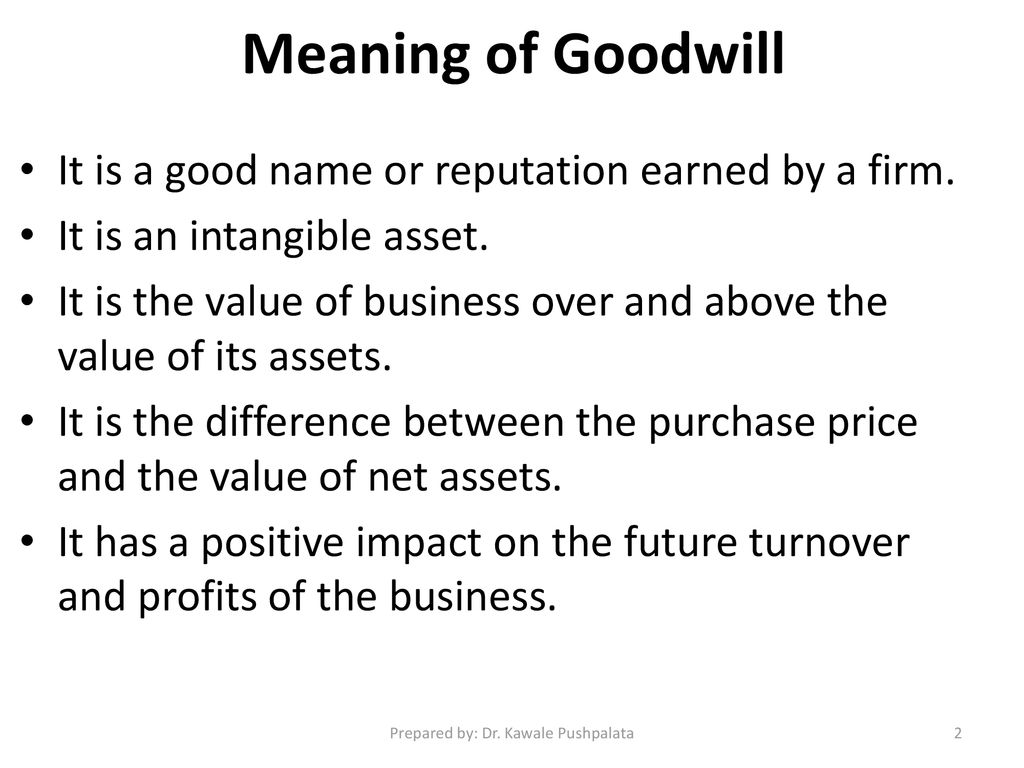

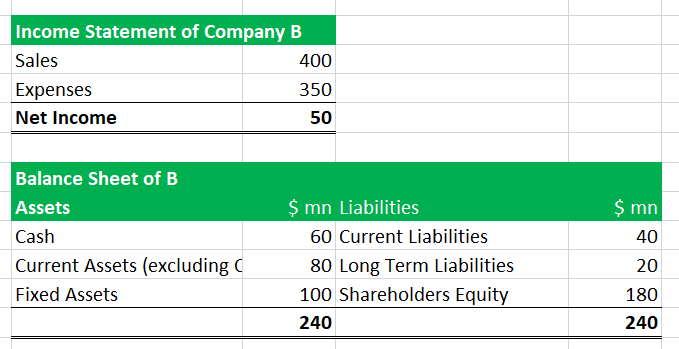

Goodwill Meaning In Accounting. The allowance is established by recognizing bad debt expense on the income statement in the same period as the associated sale is reported. In accounting goodwill is an intangible asset associated with a business combination. The amount of goodwill is the cost to purchase the business minus the fair market value of the tangible assets the intangible assets that can be identified and the liabilities. Meaning Features and Types.

Goodwill Explained The Marquee Group From marqueegroup.ca

Goodwill Explained The Marquee Group From marqueegroup.ca

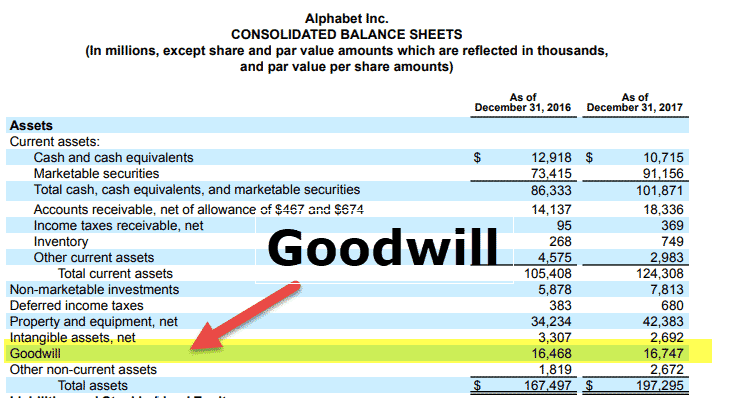

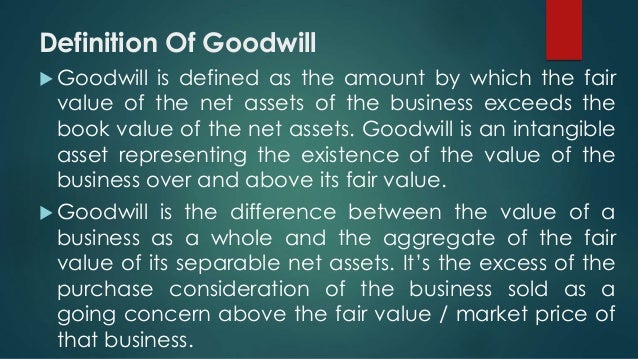

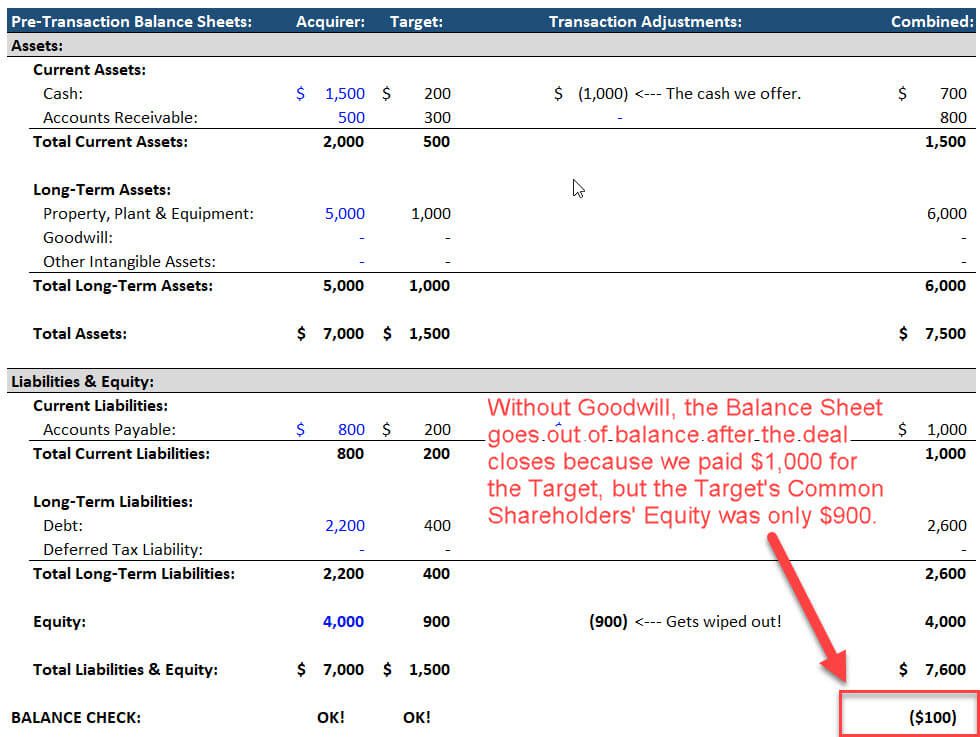

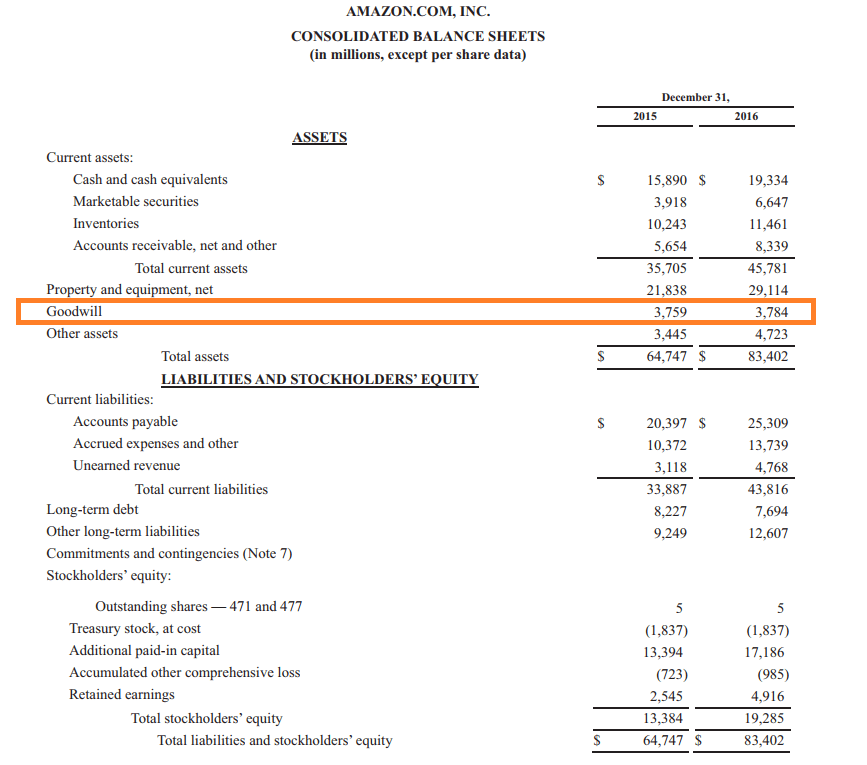

Goodwill is recorded when a company acquires purchases another company and the purchase price is greater than 1 the fair value of the identifiable tangible and intangible assets acquired minus 2 the liabilities that were assumed. But referring to the intangible asset as being created is misleading an accounting journal entry is created but the intangible asset already exists. The gap between the purchase price and the book value of a business is known as goodwill. Goodwill is an accounting construct that is required under Generally Accepted Accounting Principles GAAP. Goodwill is an intangible asset that arises when a business is acquired by another. UK Accounting Standard on Accounting for Goodwill Goodwill is the difference between the value of a business as a whole and the aggregate of the fair values of its separable net assets Lord Eldon by Goodwill is nothing more than the profitability that the old customers will resort to the old place.

Goodwill is an intangible asset that arises when a business is acquired by another.

Accounting goodwill is sometimes defined as an intangible asset that is created when a company purchases another company for a price higher than the fair market value of the target companys net assets. Find out more about goodwill accounting with our simple guide. The amount of goodwill is the cost to purchase the business minus the fair market value of the tangible assets the intangible assets that can be identified and the liabilities. Assets that are non-physical such as solid customer relationships brand recognition or excellence in management are considered tangible. The Statement of Standard Accounting Practices SSAP-22 defines goodwill as the difference between the value of a business as a whole and the aggregate of the fair values of the separable net assets. Only entities that extend credit to their customers use an allowance for doubtful accounts.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Goodwill is the amount someone would pay over and above what the assets are actually worth on paper when buying a business. In accounting goodwill is an intangible asset associated with a business combination. Goodwill in the world of business refers to the established reputation of a company as a quantifiable asset and calculated as part of its total value when it is taken over or sold. Goodwill is a companys value that exceeds its assets minus its liabilities. The amount of goodwill is the cost to purchase the business minus the fair market value of the tangible assets the intangible assets that can be identified and the liabilities.

You may pay more than what the assets are worth because the company has a great reputation which you. It is the vague and somewhat subjective excess value of a commercial enterprise or asset over its net worth. In accounting goodwill is an intangible asset associated with a business combination. Goodwill in accounting is an Intangible Asset that is generated when one company purchases another company at a price which is higher than that of the sum of the fair value of net identifiable assets of. Para 36 of AS-10 Accounting for fixed assets states that only purchased goodwill should.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

The gap between the purchase price and the book value of a business is known as goodwill. Such reputation makes popular company among its customers. Examples are Good Customer Relationships Quality Management etc. Goodwill is the excess of purchase price over the fair market value of a companys identifiable assets and liabilities. Goodwill is an accounting construct that is required under Generally Accepted Accounting Principles GAAP.

Source: marqueegroup.ca

Source: marqueegroup.ca

In accounting goodwill is an intangible asset associated with a business combination. Only entities that extend credit to their customers use an allowance for doubtful accounts. Goodwill Meaning in Accounting Goodwill arises when a company acquires another entire business. Goodwill is an intangible asset an asset thats non-physical but offers long-term value which arises when another company acquires a new business. The amount of goodwill is the cost to purchase the business minus the fair market value of the tangible assets the intangible assets that can be identified and the liabilities obtained in the purchase.

Source: slideshare.net

Source: slideshare.net

Goodwill is the amount someone would pay over and above what the assets are actually worth on paper when buying a business. Goodwill is the excess of purchase price over the fair market value of a companys identifiable assets and liabilities. According to SSAP-22 UK Accounting Standard on Accounting for Goodwill Goodwill is the difference between the value of a business as a whole and the aggregate of. In accounting goodwill is an increase in value over the companys assets minus its liabilities. UK Accounting Standard on Accounting for Goodwill Goodwill is the difference between the value of a business as a whole and the aggregate of the fair values of its separable net assets Lord Eldon by Goodwill is nothing more than the profitability that the old customers will resort to the old place.

Source: investinganswers.com

Source: investinganswers.com

Is Goodwill An Intangible Asset. Goodwill is the amount someone would pay over and above what the assets are actually worth on paper when buying a business. An intangible asset consisting of the public esteem in which a business is heldWhen a business is sold the difference between the value of the hard assets and the value of the income stream is often attributed to goodwill. Find out more about goodwill accounting with our simple guide. It is the vague and somewhat subjective excess value of a commercial enterprise or asset over its net worth.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Goodwill refers to the purchase cost minus the fair market value of the tangible assets the liabilities and the intangible assets that youre able to identify. According to SSAP-22 UK Accounting Standard on Accounting for Goodwill Goodwill is the difference between the value of a business as a whole and the aggregate of. Para 36 of AS-10 Accounting for fixed assets states that only purchased goodwill should. Goodwill is an example of Intangible Non Current Assets and it is further. Goodwill is a long-term or noncurrent asset categorized as an intangible asset.

Source: bankingprep.com

Source: bankingprep.com

Such reputation makes popular company among its customers. What Is Goodwill In Accounting. According to SSAP-22 UK Accounting Standard on Accounting for Goodwill Goodwill is the difference between the value of a business as a whole and the aggregate of. Goodwill is recorded when a company acquires purchases another company and the purchase price is greater than 1 the fair value of the identifiable tangible and intangible assets acquired minus 2 the liabilities that were assumed. The allowance is established by recognizing bad debt expense on the income statement in the same period as the associated sale is reported.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Is Goodwill An Intangible Asset. The allowance is established by recognizing bad debt expense on the income statement in the same period as the associated sale is reported. Accounting goodwill is sometimes defined as an intangible asset that is created when a company purchases another company for a price higher than the fair market value of the target companys net assets. Goodwill in the world of business refers to the established reputation of a company as a quantifiable asset and calculated as part of its total value when it is taken over or sold. Goodwill is an intangible asset an asset thats non-physical but offers long-term value which arises when another company acquires a new business.

Source: slideshare.net

Source: slideshare.net

Goodwill is an intangible asset that arises when a business is acquired by another. Accounting goodwill is sometimes defined as an intangible asset that is created when a company purchases another company for a price higher than the fair market value of the target companys net assets. You may pay more than what the assets are worth because the company has a great reputation which you. In other words goodwill shows that a business has value beyond its actually physical assets and liabilities. In accounting goodwill is an intangible asset associated with a business combination.

Source: breakingintowallstreet.com

Source: breakingintowallstreet.com

Goodwill is an example of Intangible Non Current Assets and it is further. Goodwill is a companys value that exceeds its assets minus its liabilities. Only entities that extend credit to their customers use an allowance for doubtful accounts. Examples are Good Customer Relationships Quality Management etc. What is Goodwill in accountancy terms.

Source: efinancemanagement.com

Source: efinancemanagement.com

Is Goodwill An Intangible Asset. Goodwill is an intangible asset that is associated with the purchase of one company by another. Goodwill arises when a company acquires another entire business. Such reputation makes popular company among its customers. It represents the non-physical assets such as the value created by a solid customer base brand recognition or excellence of management.

Source: slideplayer.com

Source: slideplayer.com

Goodwill is an intangible asset an asset thats non-physical but offers long-term value which arises when another company acquires a new business. Goodwill in accounting is an Intangible Asset that is generated when one company purchases another company at a price which is higher than that of the sum of the fair value of net identifiable assets of. What Is Goodwill In Accounting. The Statement of Standard Accounting Practices SSAP-22 defines goodwill as the difference between the value of a business as a whole and the aggregate of the fair values of the separable net assets. Goodwill is a companys value that exceeds its assets minus its liabilities.

Source: slideplayer.com

Source: slideplayer.com

In accounting goodwill is an increase in value over the companys assets minus its liabilities. The gap between the purchase price and the book value of a business is known as goodwill. Meaning Features and Types. The goodwill must be evaluated for impairment each year. Specifically goodwill is the portion of the purchase price that is higher than the sum of the net.

Source: byjus.com

Source: byjus.com

Examples are Good Customer Relationships Quality Management etc. It is the vague and somewhat subjective excess value of a commercial enterprise or asset over its net worth. Goodwill is the amount someone would pay over and above what the assets are actually worth on paper when buying a business. The amount of goodwill is the cost to purchase the business minus the fair market value of the tangible assets the intangible assets that can be identified and the liabilities. Some definitions of goodwill are.

Source: wikihow.com

Source: wikihow.com

An intangible asset consisting of the public esteem in which a business is heldWhen a business is sold the difference between the value of the hard assets and the value of the income stream is often attributed to goodwill. In accounting goodwill is recorded after a company acquires assets and liabilities and pays a price in excess of their identifiable net value. Goodwill in accounting is an Intangible Asset that is generated when one company purchases another company at a price which is higher than that of the sum of the fair value of net identifiable assets of. Goodwill is the amount someone would pay over and above what the assets are actually worth on paper when buying a business. The Statement of Standard Accounting Practices SSAP-22 defines goodwill as the difference between the value of a business as a whole and the aggregate of the fair values of the separable net assets.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

In accounting goodwill is an increase in value over the companys assets minus its liabilities. In other words goodwill shows that a business has value beyond its actually physical assets and liabilities. In accounting goodwill is recorded after a company acquires assets and liabilities and pays a price in excess of their identifiable net value. Assets that are non-physical such as solid customer relationships brand recognition or excellence in management are considered tangible. In accounting goodwill is an intangible asset associated with a business combination.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

In accounting goodwill is an increase in value over the companys assets minus its liabilities. Goodwill refers to the purchase cost minus the fair market value of the tangible assets the liabilities and the intangible assets that youre able to identify. In accounting goodwill is recorded after a company acquires assets and liabilities and pays a price in excess of their identifiable net value. According to SSAP-22 UK Accounting Standard on Accounting for Goodwill Goodwill is the difference between the value of a business as a whole and the aggregate of. Goodwill is an example of Intangible Non Current Assets and it is further.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title goodwill meaning in accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 36++ The rarest football card Popular

- 24+ Jmia Stock

- 49++ Lemonade share price Trending

- 37+ Rare books reddit Mining

- 30++ Funko pop vikings Stock

- 39+ Not legal tender money Best

- 31+ Intangible assets meaning Mining

- 19+ General grievous funko pop News

- 21++ Fund manager Wallet

- 15+ Understanding cryptocurrency Trend