46++ Qualified leasehold improvements Popular

Home » Exchange » 46++ Qualified leasehold improvements PopularYour Qualified leasehold improvements wallet are obtainable. Qualified leasehold improvements are a mining that is most popular and liked by everyone today. You can Get the Qualified leasehold improvements files here. Find and Download all free bitcoin.

If you’re searching for qualified leasehold improvements pictures information linked to the qualified leasehold improvements keyword, you have come to the ideal site. Our site frequently provides you with suggestions for seeing the highest quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

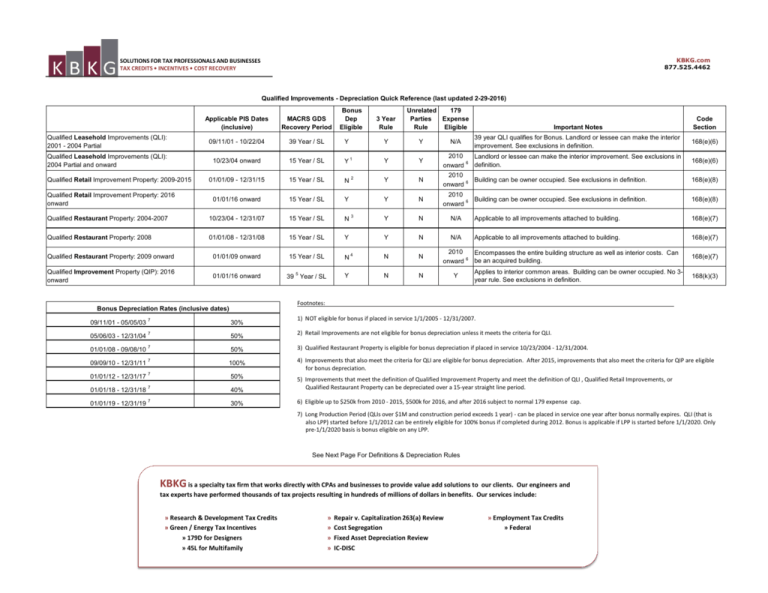

Qualified Leasehold Improvements. Differences with Qualified Leasehold Improvements The QIP definition is similar to that of Qualified Leasehold Improvements. However there are subtle but distinct differences to note. And 3 did not enlarge the building install or upgrade elevators and. These may include upgrades or replacements for security systems woodwork air conditioning electrical systems plumbing and permanent floor coverings.

Supersociedades Resuelve Conflictos De Levantamiento Del Velo Corporativo De Sociedades Comercial Sociedades Comerciales Toma De Decisiones Resolver Conflictos From in.pinterest.com

Supersociedades Resuelve Conflictos De Levantamiento Del Velo Corporativo De Sociedades Comercial Sociedades Comerciales Toma De Decisiones Resolver Conflictos From in.pinterest.com

These may include upgrades or replacements for security systems woodwork air conditioning electrical systems plumbing and permanent floor coverings. And 3 did not enlarge the building install or upgrade elevators and. Significantly the Procedure provides a method for taxpayers to expense QIP placed in service in 2018 or 2019 or change the depreciation method without filing amended returns for. Qualified Leasehold Improvements Therefore leasehold improvements are any improvements made by the lessee who is renting from the lessor and for which the lessee will use throughout the life of the lease agreement. Leasehold improvements are considered qualified improvement property for tax purposes along with building improvements qualified restaurant. Under prior law assets with lives of 20 years or less were eligible for 50 percent bonus depreciation.

It includes the former qualified leasehold improvement property qualified restaurant property and qualified retail property.

2 were placed in service more than three years after the nonresidential building was first placed in service. A common question among entities who are installing leasehold improvements is What is Qualified Leasehold Improvement Property Qualified Improvement Property QIP is a term found in the Internal Revenue Code Section 168 and encompasses any improvements made to the interior of a commercial real property. Under prior law assets with lives of 20 years or less were eligible for 50 percent bonus depreciation. Improvements to leasehold property qualified for the 15-year cost recovery period if they 1 were made according to the terms of a lease by the lessee or the lessor. Significantly the Procedure provides a method for taxpayers to expense QIP placed in service in 2018 or 2019 or change the depreciation method without filing amended returns for. Any enhancement to a commercial space can be considered a leasehold improvement.

Source: in.pinterest.com

Source: in.pinterest.com

Leasehold improvements are considered qualified improvement property for tax purposes along with building improvements qualified restaurant property and qualified retail improvements under the Tax Cuts and Jobs Act of 2017. For one Qualified Improvement Property does not have the Qualified Leasehold Improvements requirement that a building must have been placed in service at least three years prior to the expenditure. Leasehold and other improvements to existing buildings qualified improvement property or QIP. In the case where leasehold improvements are considered to be a fixed asset there is a need to ensure that the expense meets the capitalization criteria. Qualified Improvement Property QIP accelerates significant deductions to enhance cash flow for taxpayers who are improving andor renovating an existing building.

Source: pinterest.com

Source: pinterest.com

Qualified Leasehold Improvements Therefore leasehold improvements are any improvements made by the lessee who is renting from the lessor and for which the lessee will use throughout the life of the lease agreement. These types of improvements can increase the value of a property by making vital building functions safer and more reliable for lessees. Qualified leasehold improvement property QLIA 20012017 A Any improvement to an interior portion of a building which is nonresidential real property if i such improvement is made under or pursuant to a lease I by the lessee or any sublessee of such portion. And 3 did not enlarge the building install or upgrade elevators and. Any enhancement to a commercial space can be considered a leasehold improvement.

Source:

Furthermore the new law also eliminated separate asset categories for qualified leasehold improvements qualified restaurant property and qualified retail improvement property effectively lumping all these separate classes into the QIP category that no longer qualifies for bonus depreciation. Qualified Leasehold Improvements Therefore leasehold improvements are any improvements made by the lessee who is renting from the lessor and for which the lessee will use throughout the life of the lease agreement. Qualified leasehold improvement property QLIA 20012017 A Any improvement to an interior portion of a building which is nonresidential real property if i such improvement is made under or pursuant to a lease I by the lessee or any sublessee of such portion. Leasehold improvements are considered qualified improvement property for tax purposes along with building improvements qualified restaurant property and qualified retail improvements under the Tax Cuts and Jobs Act of 2017. Any enhancement to a commercial space can be considered a leasehold improvement.

Source: pinterest.com

Source: pinterest.com

However expenditures attributable to the enlargement of the building elevators or. Differences with Qualified Leasehold Improvements The QIP definition is similar to that of Qualified Leasehold Improvements. However expenditures attributable to the enlargement of the building elevators or. A common question among entities who are installing leasehold improvements is What is Qualified Leasehold Improvement Property Qualified Improvement Property QIP is a term found in the Internal Revenue Code Section 168 and encompasses any improvements made to the interior of a commercial real property. Leasehold improvements are considered qualified improvement property for tax purposes along with building improvements qualified restaurant.

Source: forbes.com

Source: forbes.com

Improvements to leasehold property qualified for the 15-year cost recovery period if they 1 were made according to the terms of a lease by the lessee or the lessor. Leasehold improvements are considered qualified improvement property for tax purposes along with building improvements qualified restaurant. Leasehold improvements are considered qualified improvement property for tax purposes along with building improvements qualified restaurant property and qualified retail improvements under the Tax Cuts and Jobs Act of 2017. What are qualified leasehold improvements. Furthermore the new law also eliminated separate asset categories for qualified leasehold improvements qualified restaurant property and qualified retail improvement property effectively lumping all these separate classes into the QIP category that no longer qualifies for bonus depreciation.

Source:

Improvements to the vital infrastructure of a building including electrical plumbing and security systems are considered qualified leasehold improvements. 2 were placed in service more than three years after the nonresidential building was first placed in service. Improvements to the vital infrastructure of a building including electrical plumbing and security systems are considered qualified leasehold improvements. And 3 did not enlarge the building install or upgrade elevators and. For one Qualified Improvement Property does not have the Qualified Leasehold Improvements requirement that a building must have been placed in service at least three years prior to the expenditure.

Source:

A common question among entities who are installing leasehold improvements is What is Qualified Leasehold Improvement Property Qualified Improvement Property QIP is a term found in the Internal Revenue Code Section 168 and encompasses any improvements made to the interior of a commercial real property. If the Section 110 requirements are met theres no income recognized by the tenant to the extent the allowance is. Improvements to the vital infrastructure of a building including electrical plumbing and security systems are considered qualified leasehold improvements. Any leasehold improvements made to an interior portion of a building after 2004 may qualify for 15-year straight-line depreciation and it may additionally qualify for bonus depreciation if it was placed in service after December 31st of 2007. The lessee is the owner of these improvements until the expiration of the rental contract.

Source: badermartin.com

Source: badermartin.com

Qualified Improvement Property QIP accelerates significant deductions to enhance cash flow for taxpayers who are improving andor renovating an existing building. If the Section 110 requirements are met theres no income recognized by the tenant to the extent the allowance is. In Chief Counsel Advice CCA IRS has concluded that heating ventilation and air-conditioning HVAC units installed outside of a building or on its roof are ineligible to be treated as qualified leasehold improvement property QLIP and thus cant be depreciated over 15 years and arent eligible for bonus depreciation. QIP is a tax classification of assets that generally includes interior non-structural improvements to nonresidential buildings placed-in-service after the buildings were originally placed-in-service. A common question among entities who are installing leasehold improvements is What is Qualified Leasehold Improvement Property Qualified Improvement Property QIP is a term found in the Internal Revenue Code Section 168 and encompasses any improvements made to the interior of a commercial real property.

Source: pinterest.com

Source: pinterest.com

Qualified leasehold improvement property qualified restaurant property and qualified retail improvement property. Any leasehold improvements made to an interior portion of a building after 2004 may qualify for 15-year straight-line depreciation and it may additionally qualify for bonus depreciation if it was placed in service after December 31st of 2007. For one Qualified Improvement Property does not have the Qualified Leasehold Improvements requirement that a building must have been placed in service at least three years prior to the expenditure. Under prior law assets with lives of 20 years or less were eligible for 50 percent bonus depreciation. Qualified leasehold improvement property QLIA 20012017 A Any improvement to an interior portion of a building which is nonresidential real property if i such improvement is made under or pursuant to a lease I by the lessee or any sublessee of such portion.

Source:

If the Section 110 requirements are met theres no income recognized by the tenant to the extent the allowance is. 1250 property made by the taxpayer to an interior portion of a nonresidential building placed in service after the date the building was placed in service. These types of improvements can increase the value of a property by making vital building functions safer and more reliable for lessees. Qualified improvement property QIP is any improvement that is Sec. Any leasehold improvements made to an interior portion of a building after 2004 may qualify for 15-year straight-line depreciation and it may additionally qualify for bonus depreciation if it was placed in service after December 31st of 2007.

Source:

1250 property made by the taxpayer to an interior portion of a nonresidential building placed in service after the date the building was placed in service. However expenditures attributable to the enlargement of the building elevators or. What are qualified leasehold improvements. Qualified leasehold improvement property QLIA 20012017 A Any improvement to an interior portion of a building which is nonresidential real property if i such improvement is made under or pursuant to a lease I by the lessee or any sublessee of such portion. Leasehold and other improvements to existing buildings qualified improvement property or QIP.

Source: studylib.net

Source: studylib.net

Leasehold improvements are considered qualified improvement property for tax purposes along with building improvements qualified restaurant. In Chief Counsel Advice CCA IRS has concluded that heating ventilation and air-conditioning HVAC units installed outside of a building or on its roof are ineligible to be treated as qualified leasehold improvement property QLIP and thus cant be depreciated over 15 years and arent eligible for bonus depreciation. Accounting for Leasehold Improvement. Qualified Leasehold Improvements QLI Not everyone knows that there is tax law that may allow a building owner to find significant tax savings for their leasehold property. Furthermore the new law also eliminated separate asset categories for qualified leasehold improvements qualified restaurant property and qualified retail improvement property effectively lumping all these separate classes into the QIP category that no longer qualifies for bonus depreciation.

Source: pinterest.com

Source: pinterest.com

It includes the former qualified leasehold improvement property qualified restaurant property and qualified retail property. Prior to the Tax Cuts and Jobs Act the tax code categorized certain interior building improvements into different classes. Qualified Improvement Property QIP accelerates significant deductions to enhance cash flow for taxpayers who are improving andor renovating an existing building. The lessee is the owner of these improvements until the expiration of the rental contract. For one Qualified Improvement Property does not have the Qualified Leasehold Improvements requirement that a building must have been placed in service at least three years prior to the expenditure.

Source: educba.com

Source: educba.com

Qualified Leasehold Improvements QLI Not everyone knows that there is tax law that may allow a building owner to find significant tax savings for their leasehold property. Qualified leasehold improvements are tax-deductible changes to the insides of leased nonresidential property. Any enhancement to a commercial space can be considered a leasehold improvement. QIP is a tax classification of assets that generally includes interior non-structural improvements to nonresidential buildings placed-in-service after the buildings were originally placed-in-service. These types of improvements can increase the value of a property by making vital building functions safer and more reliable for lessees.

Source: pinterest.com

Source: pinterest.com

If the Section 110 requirements are met theres no income recognized by the tenant to the extent the allowance is. The lessee is the owner of these improvements until the expiration of the rental contract. If the Section 110 requirements are met theres no income recognized by the tenant to the extent the allowance is. In the case where leasehold improvements are considered to be a fixed asset there is a need to ensure that the expense meets the capitalization criteria. Leasehold improvements are considered qualified improvement property for tax purposes along with building improvements qualified restaurant property and qualified retail improvements under the Tax Cuts and Jobs Act of 2017.

Source: pl.pinterest.com

Source: pl.pinterest.com

However there are subtle but distinct differences to note. Leasehold Improvements can be considered to be either an asset or an expense. The lessee is the owner of these improvements until the expiration of the rental contract. Qualified leasehold improvement property qualified restaurant property and qualified retail improvement property. Capitalization Depreciation.

Source: pinterest.com

Source: pinterest.com

Differences with Qualified Leasehold Improvements The QIP definition is similar to that of Qualified Leasehold Improvements. What are qualified leasehold improvements. Under prior law assets with lives of 20 years or less were eligible for 50 percent bonus depreciation. QIP is a tax classification of assets that generally includes interior non-structural improvements to nonresidential buildings placed-in-service after the buildings were originally placed-in-service. Qualified improvement property QIP is any improvement that is Sec.

Source: pinterest.com

Source: pinterest.com

Prior to the Tax Cuts and Jobs Act the tax code categorized certain interior building improvements into different classes. QIP is a tax classification of assets that generally includes interior non-structural improvements to nonresidential buildings placed-in-service after the buildings were originally placed-in-service. For one Qualified Improvement Property does not have the Qualified Leasehold Improvements requirement that a building must have been placed in service at least three years prior to the expenditure. In the case where leasehold improvements are considered to be a fixed asset there is a need to ensure that the expense meets the capitalization criteria. What are qualified leasehold improvements.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title qualified leasehold improvements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.