39++ Return on stockholders equity Mining

Home » Bitcoin » 39++ Return on stockholders equity MiningYour Return on stockholders equity news are available in this site. Return on stockholders equity are a exchange that is most popular and liked by everyone this time. You can Download the Return on stockholders equity files here. News all royalty-free coin.

If you’re looking for return on stockholders equity images information related to the return on stockholders equity interest, you have come to the ideal blog. Our website always gives you hints for refferencing the highest quality video and image content, please kindly search and find more informative video content and images that fit your interests.

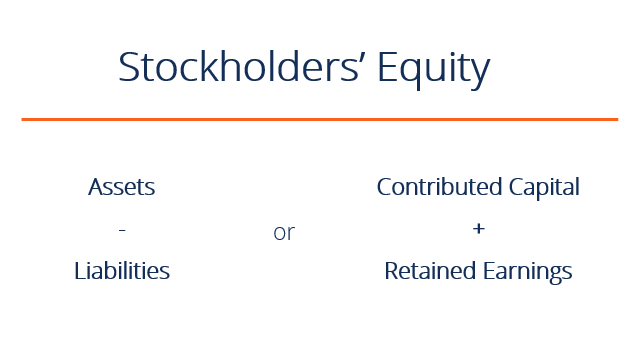

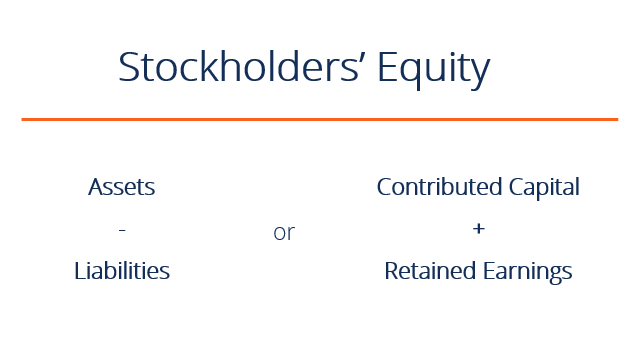

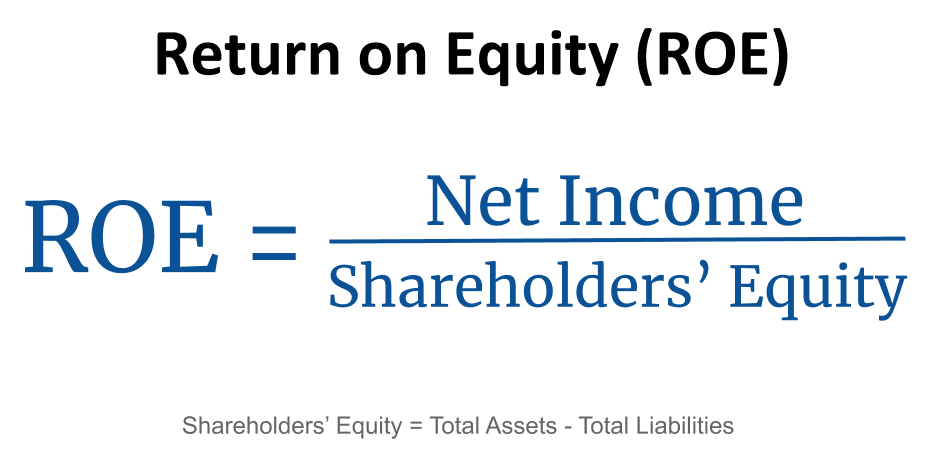

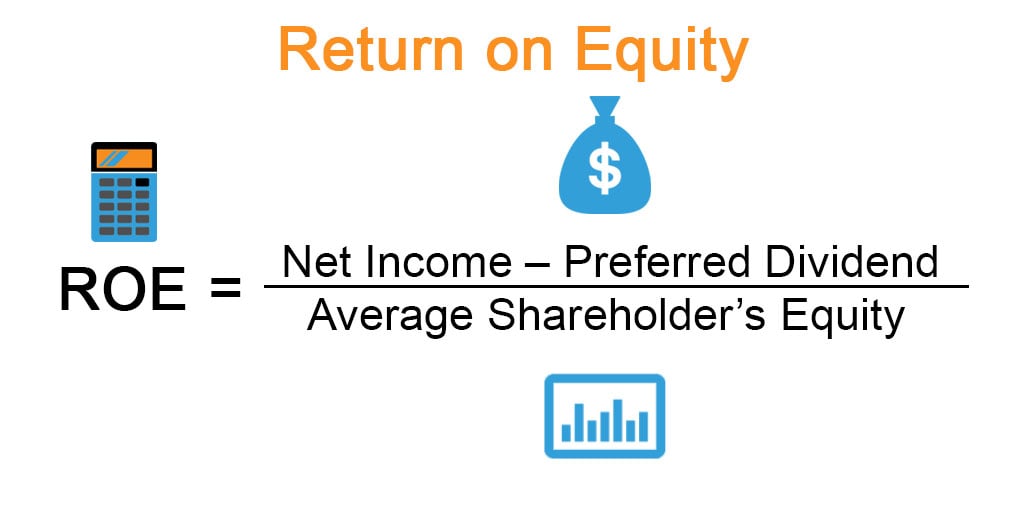

Return On Stockholders Equity. Return on average equity ROAE can give a more accurate depiction of a companys profitability compared to ROE if the value of shareholders equity has altered considerably through the period. This is one of the different variations of return on investment. The return on stockholders equity or return on equity is a corporations net income after income taxes divided by average amount of stockholders equity during the period of the net income. Return on Equity Net Income Average Common Stockholder Equity for the Period Shareholder equity is equal to total assets minus total liabilities.

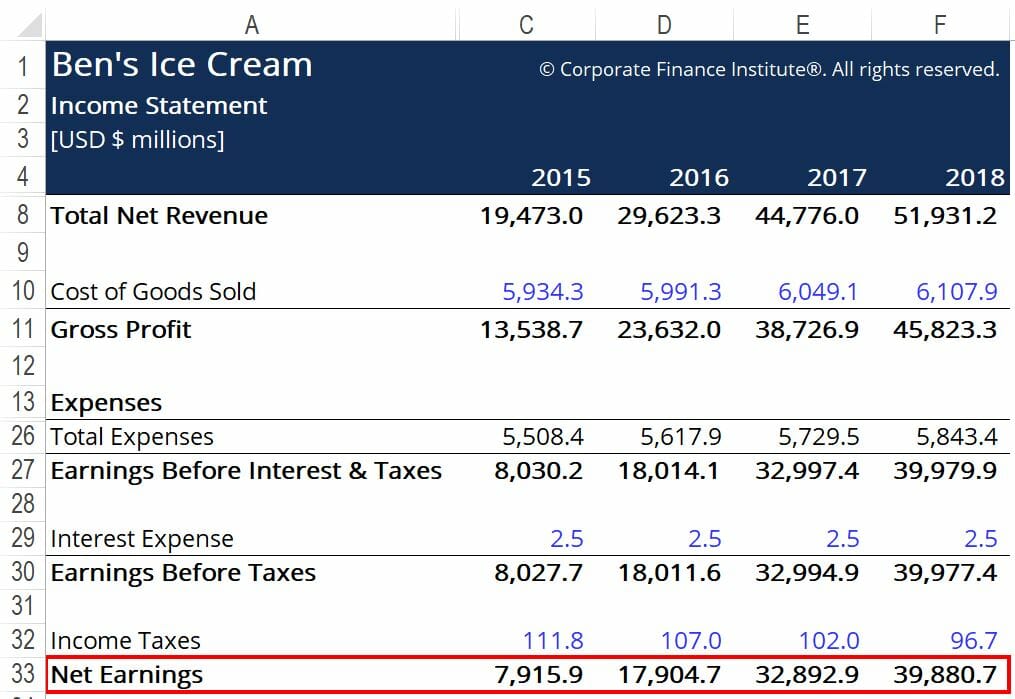

Stockholders Equity Balance Sheet Guide Examples Calculation From corporatefinanceinstitute.com

Stockholders Equity Balance Sheet Guide Examples Calculation From corporatefinanceinstitute.com

Ratio indicating the earnings on the common stockholders investment. Shareholder equity is a product of accounting that represents the assets created by the retained earnings of the business and the paid-in capital of the owners. To calculate ROE one would divide net income by. Firms with a higher return on equity are more efficient in generating. 2021 was 33674 Mil. Return on Equity Net Income Average Common Stockholder Equity for the Period Shareholder equity is equal to total assets minus total liabilities.

Hitunglah Return on Equity ROE.

Return on stockholders equity is the percentage of equity a company earns as profit during one accounting period typically a year. Firms with a higher return on equity are more efficient in generating. To calculate ROE one would divide net income by. What Does Return on Common Shareholders Equity Mean. Often called simply return on equity this metric is a good measure of management performance because it tells investors how efficiently equity is. It is computed by dividing the net income available for common stockholders by common stockholders equity.

Source: chegg.com

Source: chegg.com

It is computed by dividing the net income available for common stockholders by common stockholders equity. The return on stockholders equity or return on equity is a corporations net income after income taxes divided byaverage amount of stockholders equity during the period of the net income. To calculate ROE one would divide net income by. Firms with a higher return on equity are more efficient in generating. Return on equity or ROE is a profitability ratio that measures the rate of return on resources provided for by a companys stockholders equity.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

What Does Return on Common Shareholders Equity Mean. Return on common stockholders equity ratio measures the success of a company in generating income for the benefit of common stockholders. To illustrate lets assume that a corporations net income after tax was 100000 for the most recent year. The return on stockholders equity or return on equity is a corporations net income after income taxes divided by average amount of stockholders equity during the period of the net income. Return on average equity ROAE can give a more accurate depiction of a companys profitability compared to ROE if the value of shareholders equity has altered considerably through the period.

Source: youtube.com

Source: youtube.com

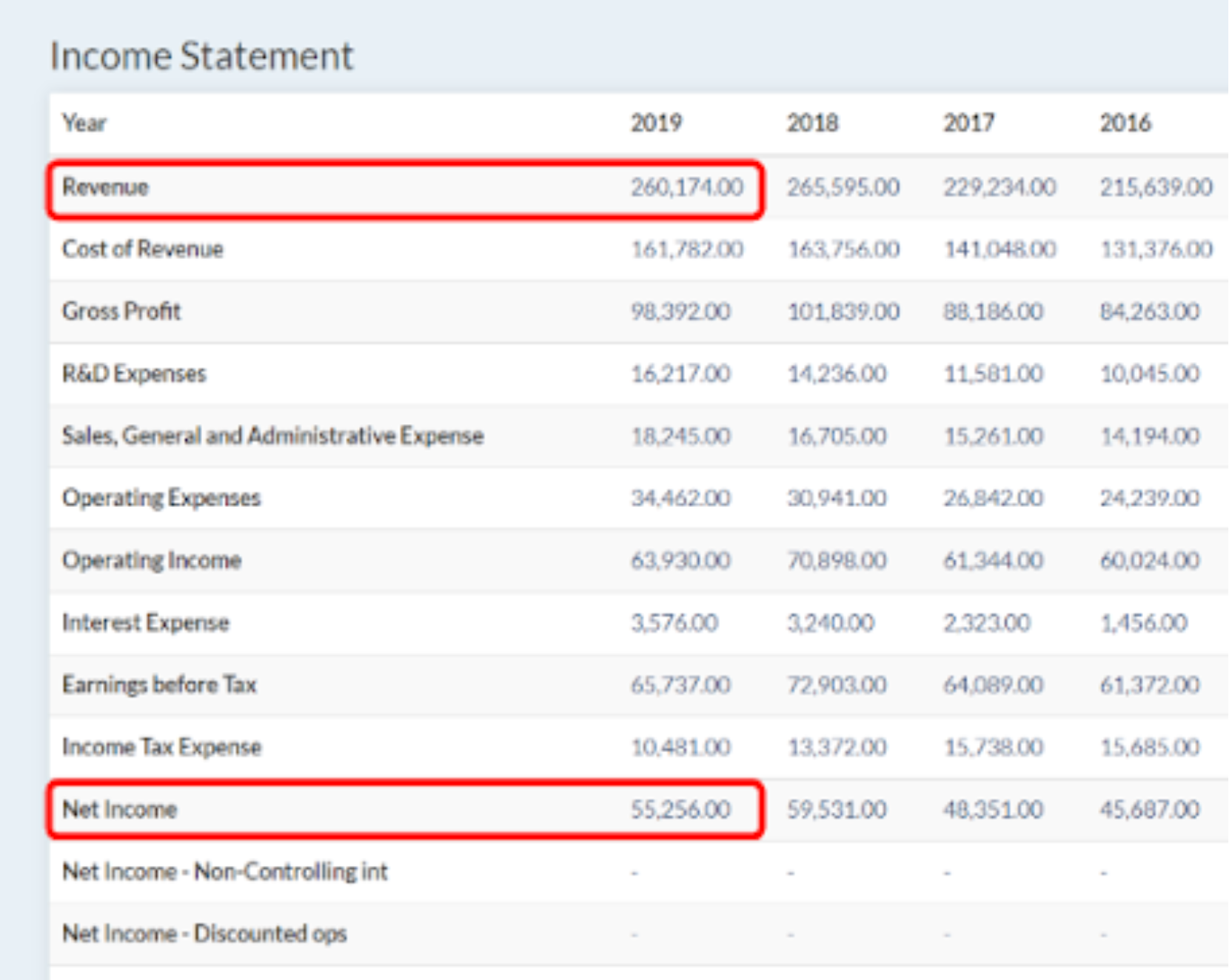

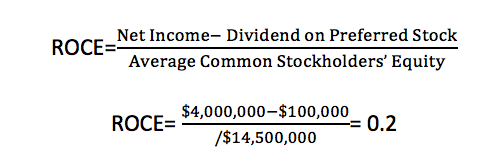

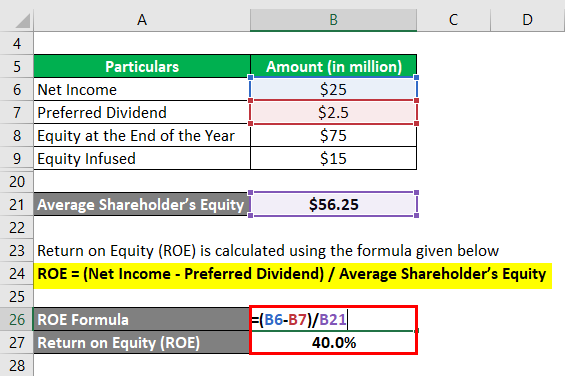

Retrun on Equity Net Income Shareholders Equity Return on Equity 4000000080000000. Return on Equity ROE is a measure of a companys profitability that takes a companys annual return net income divided by the value of its total shareholders equity ie. Return on common stockholders equity ratio measures the success of a company in generating income for the benefit of common stockholders. Return on equity or ROE is a profitability ratio that measures the rate of return on resources provided for by a companys stockholders equity. Return on common stockholders equity ratio measures the success of a company in generating income for the benefit of common stockholders.

Source: slidetodoc.com

Source: slidetodoc.com

Definition - What is Return on Common Stockholders Equity ROCE. Ratio indicating the earnings on the common stockholders investment. Sebagai contoh bagikan laba bersih Rp1000000000 dengan ekuitas rata-rata pemegang. Return on stockholders equity is determined by dividing the companys net earnings by the total amount of stockholders equity. Return on Equity Net Income Average Common Stockholder Equity for the Period Shareholder equity is equal to total assets minus total liabilities.

Source: youtube.com

Source: youtube.com

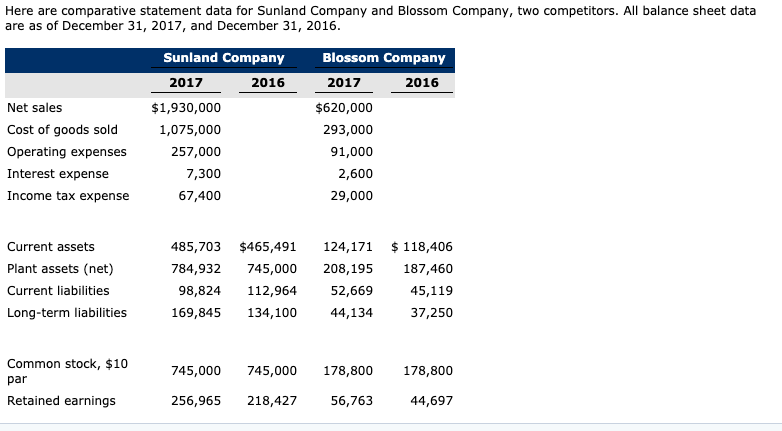

Return on average equity ROAE can give a more accurate depiction of a companys profitability compared to ROE if the value of shareholders equity has altered considerably through the period. The ratio is usually expressed in percentage. Assuming that share and each companys stock can be purchased at 75 per share compute their e. Retrun on Equity Net Income Shareholders Equity Return on Equity 4000000080000000. Return on average equity ROAE can give a more accurate depiction of a companys profitability compared to ROE if the value of shareholders equity has altered considerably through the period.

Source: id.wikihow.com

Source: id.wikihow.com

To learn more about this ratio see Explanation of Financial Ratios. It is computed by dividing the net income available for common stockholders by common stockholders equity. Often called simply return on equity this metric is a good measure of management performance because it tells investors how efficiently equity is. The return on common stockholders equity ratio is the proportion of a firms net income that is payable to the common stockholders. Return on Equity ROE is a measure of a companys profitability that takes a companys annual return net income divided by the value of its total shareholders equity ie.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

ROCE indicates the proportion of the net income that a firm generates by each dollar of common equity invested. To calculate ROE one would divide net income by. Bagikan laba bersih dengan ekuitas rata-rata pemegang saham. It is computed by dividing the net income available for common stockholders by common stockholders equity. The return on common stockholders equity ratio often known as return on equity or ROE allows you to calculate the returns a company is able to generate from the equity that common shareholders have invested in it.

Source: medium.com

Source: medium.com

2021 was 33674 Mil. Return on average equity ROAE can give a more accurate depiction of a companys profitability compared to ROE if the value of shareholders equity has altered considerably through the period. Return on stockholders equity definition. Return on equity ROE is a financial ratio that shows how well a company is managing the capital that shareholders have invested in it. The ratio is usually expressed in percentage.

Source: stockanalysis.com

Source: stockanalysis.com

Firms with a higher return on equity are more efficient in generating. The result of dividing a corporations net income by the average amount of common stockholders equity during the time interval when the net income was earned. To get an even more accurate perspective look at other ratios as well as results from other companies of the same industry and past results. The return on stockholders equity or return on equity is a corporations net income after income taxes divided byaverage amount of stockholders equity during the period of the net income. It is computed by dividing the net income available for common stockholders by common stockholders equity.

Source: bdc.ca

Source: bdc.ca

This Proves that Company ABC generated a profit of 050 for every 1 of shareholders equity in the year 2017 and. Return on equity or ROE is a profitability ratio that measures the rate of return on resources provided for by a companys stockholders equity. Return on common stockholders equity ratio measures the success of a company in generating income for the benefit of common stockholders. Return on Equity 50. This is one of the different variations of return on investment.

Source: educba.com

Source: educba.com

Return on equity ROE is a measure of financial performance calculated by dividing net income by shareholders equity. The ratio is usually expressed in percentage. ROCE indicates the proportion of the net income that a firm generates by each dollar of common equity invested. To get an even more accurate perspective look at other ratios as well as results from other companies of the same industry and past results. Firms with a higher return on equity are more efficient in generating.

Source: stockmaster.com

Source: stockmaster.com

For both companies compute the a profit margin ratio b total asset turnover c return on total assets and d return on common stockholders equity. Return on equity ROE is a financial ratio that shows how well a company is managing the capital that shareholders have invested in it. Return on average equity ROAE can give a more accurate depiction of a companys profitability compared to ROE if the value of shareholders equity has altered considerably through the period. Hence it is also known as return on stockholders equity or ROSHE. Return on Equity Net Income Average Common Stockholder Equity for the Period Shareholder equity is equal to total assets minus total liabilities.

Source: educba.com

Source: educba.com

Hitunglah Return on Equity ROE. The ratio is usually expressed in percentage. To get an even more accurate perspective look at other ratios as well as results from other companies of the same industry and past results. 2021 was 33674 Mil. To calculate ROE one would divide net income by.

Source: qsstudy.com

Source: qsstudy.com

Often called simply return on equity this metric is a good measure of management performance because it tells investors how efficiently equity is. The return on stockholders equity or return on equity is a corporations net income after income taxes divided by average amount of stockholders equity during the period of the net income. Return on equity ROE is a measure of financial performance calculated by dividing net income by shareholders equity. Shareholder equity is a product of accounting that represents the assets created by the retained earnings of the business and the paid-in capital of the owners. To learn more about this ratio see Explanation of Financial Ratios.

Source: chegg.com

Source: chegg.com

Return on Equity Net Income Average Common Stockholder Equity for the Period Shareholder equity is equal to total assets minus total liabilities. What Does Return on Common Shareholders Equity Mean. To learn more about this ratio see Explanation of Financial Ratios. To illustrate lets assume that a corporations net income after tax was 100000 for the most recent year. Bagikan laba bersih dengan ekuitas rata-rata pemegang saham.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The ratio is usually expressed in percentage. Return on average equity ROAE can give a more accurate depiction of a companys profitability compared to ROE if the value of shareholders equity has altered considerably through the period. Return on equity ROE is a measure of financial performance calculated by dividing net income by shareholders equity. Often called simply return on equity this metric is a good measure of management performance because it tells investors how efficiently equity is. To calculate ROE one would divide net income by.

Source: slidetodoc.com

Source: slidetodoc.com

To get an even more accurate perspective look at other ratios as well as results from other companies of the same industry and past results. The return on common stockholders equity ratio is the proportion of a firms net income that is payable to the common stockholders. The ratio is usually expressed in percentage. Return on equity or ROE is a profitability ratio that measures the rate of return on resources provided for by a companys stockholders equity. It is computed by dividing the net income available for common stockholders by common stockholders equity.

Source: investopedia.com

Source: investopedia.com

Shareholder equity is a product of accounting that represents the assets created by the retained earnings of the business and the paid-in capital of the owners. 2021 was 33674 Mil. Return on stockholders equity is determined by dividing the companys net earnings by the total amount of stockholders equity. To get an even more accurate perspective look at other ratios as well as results from other companies of the same industry and past results. Bagikan laba bersih dengan ekuitas rata-rata pemegang saham.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title return on stockholders equity by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.